Business News›Budget 2025

Budget 2025: Key Numbers

Budget and Markets

Budget boost for earnings! 3 reasons why double-digit Nifty EPS growth is possible in FY26

Consumption over capex. How the Budget impacts stock market investors

Consumption over capex. How the Budget impacts stock market investors

Budget 2025: Triveni of fiscal discipline, capital expenditure, and consumption growth with a holy ‘dip-regulation’

Tactical move! Stock market investors need a marked strategy shift in post-Budget play

Budget 2025: PSU stocks tumble up to 9% on Budget Day, marking the sharpest decline since 2020

Budget 2025: PSU stocks tumble up to 9% on Budget Day, marking the sharpest decline since 2020

Sectors In Focus

From Hyderabad to Hamburg: Home-grown HIL triples manufacturing muscle

From Hyderabad to Hamburg: Home-grown HIL triples manufacturing muscle

Budget 2025: Relief for a larger segment of Indian promoters under the insolvency code

Union Budget 2025 receives mixed reactions from Ludhiana’s MSMEs

Budget 2025 impact on MSME, exports, indirect taxes and Ease of Doing Business

Now, ‘Heal in India’—Budget push can elevate India as a global healthcare destination: India Inc

Energy

India to prioritise energy infrastructure in capex shift from FY25-30: Report

India to prioritise energy infrastructure in capex shift from FY25-30: Report

BPCL plans to invest $2.9 billion in exploration in Mozambique, Brazil

India has potential to be key sustainable aviation fuel producer, says IATA official

Morgan Stanley, HSBC cut oil supply forecast, predict $70 Brent after OPEC decision

Blended aviation turbine fuel gets new category, to be taxed at 2% for regional connectivity

Auto

Maruti Suzuki partners with Hero FinCorp to expand car loan offerings

Maruti Suzuki partners with Hero FinCorp to expand car loan offerings

Nissan board to meet on March 11, discuss potential CEO successors, sources say

Automobile parts companies look to tap unaffected countries amid US tariff threats

Skoda Auto VW in talks with JSW & Tata Motors for e-car deal

Hyundai falls behind M&M, Tata Motors in Feb retail sales: FADA

Banking

Banking sector must continue to innovate, lead amid changing global landscape: FM Nirmala Sitharaman

Banking sector must continue to innovate, lead amid changing global landscape: FM Nirmala Sitharaman

RBI allows IndusInd CEO one year extension instead of usual three

RBI's VRR auctions see muted response on easing liquidity

SBI launches collateral-free loans for women entrepreneurs

Nippon Life is said to consider buying stake in IndusInd Bank

Travel

Long Holi weekend boosts travel searches and hotel bookings

Long Holi weekend boosts travel searches and hotel bookings

A bigger India: The economics behind building tourism beyond the Taj Mahal

February gets a clean sweep as Maha Kumbh drives up travel bookings

Luxmi Group signs MoU with Assam govt to promote tea tourism

MEA leads envoys to Kaziranga as Assam seeks travel ban end

Tech

Chinese investors privately take stakes in Elon Musk's companies: report

Chinese investors privately take stakes in Elon Musk's companies: report

Diversity pullback: Tech giants lead US companies in pulling back on initiatives

AI will amplify India’s workforce, not replace it

Ather Energy converts preference shares into equity; likely to launch IPO in April

Partnering to propel India’s AI revolution

- Budget 2025: Top 10 key takeaways from FM Sitharaman's speech, watch!Budget 2025: PM lauds FM's announcement of Rs 2 cr loans for 1st time SC/ST & women entrepreneurs

04:39Budget 2025: Modi's mega booster gift to Bihar with Makhana board, food processing units and more

04:39Budget 2025: Modi's mega booster gift to Bihar with Makhana board, food processing units and more 06:19Budget 2025: FM announces agri reforms for 1.7 crore farmers, 6-year pulse self-reliance mission

06:19Budget 2025: FM announces agri reforms for 1.7 crore farmers, 6-year pulse self-reliance mission 08:56

08:56

India’s Economic Trends

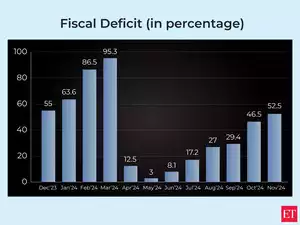

Fiscal Deficit

Infra Output

Manufacturing PMI

Services PMI

Retail Inflation

WPI

Trade Deficit

Export

Import

GST

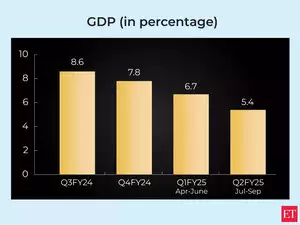

GDP

Spot The FM

Pick and drag the FM on the right with your cursor and match with the budgetary proposal on the left.

Details on Budget 2025

Union Budget 2025

Finance Minister Nirmala Sitharaman unveiled the first full Budget of Modi 3.0 today, focusing on tax relief for the middle class, allowing total tax exemption for income up to Rs 12 lakh per annum. In her speech, she emphasized the Budget's goals of supporting the GYAN (Garib, Yuva, Annadata, and Nari shakti) — the poor, farmers, women, and youth. She also made notable announcements for Bihar, where elections are anticipated later this year.

Budget 2025: Major Highlights

Budget Theme

The Budget aims to implement transformative reforms in six key areas: taxation, power, urban development, financial sector, mining, and regulatory reforms. It emphasizes inclusive development to enhance middle-class spending power, viewing the next five years as a unique opportunity for widespread growth.

Income Tax Changes

A New Income Tax Bill will be introduced next week, featuring no income tax for incomes up to Rs 12 lakh and nil tax on Rs 12.75 lakh due to a standard deduction. The proposed simplified tax structure will benefit taxpayers across various income brackets. Notable changes include doubling the tax deduction limit for senior citizens and removing TCS on education remittances.

Following are the revised slabs and rates under new tax regime announced in the FY26 Budget:

Income up to Rs 4 lakh (per annum) ----- Nil

Between Rs 4 and 8 lakh ---------------- 5 per cent (tax)

Between Rs 8 and 12 lakh --------------- 10 per cent

Between Rs 12 and 16 lakh -------------- 15 per cent

Between Rs16 and 20 lakh --------------- 20 per cent

Between Rs 20 and 24 lakh -------------- 25 per cent

Above Rs 24 lakh ------------------------- 30 per cent

* Nil tax slab will apply for annual income up to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers with a standard deduction of Rs 75,000) under new tax regime.

Tax Moves for Businesses

Significant tax measures include making 36 life-saving drugs duty-free, cutting custom duty on lithium batteries, and reducing BCD on various goods. An asset monetization plan aims to generate Rs 10 lakh crore, while FDI in the insurance sector will increase to 100%.

State of the Economy

The FY25 fiscal deficit is projected at 4.8%, with a revised capex of Rs 10.18 lakh crore. Total receipts and expenditures for FY26 are estimated at Rs 34.96 lakh crore and Rs 50.65 lakh crore, respectively.

Big Measures for Agriculture

Initiatives include a new urea plant in Assam, a National Mission on High Yielding Seeds, and a five-year mission to boost cotton productivity. The Modified Interest Subvention Scheme will raise loan limits for farmers, and a PM Dhan Dhyan Krishi Yojana will target low-yield districts.

Reforms Announced

Plans include developing an asset monetization strategy and setting up a High-Level Committee for regulatory reforms. A National Manufacturing Mission will be launched to boost India's production capacity.

Infrastructure and Economy

Each ministry will devise a three-year project pipeline for PPP implementation, and states will receive Rs 1.5 lakh crore in interest-free loans for infrastructure development.

Education Schemes

The Budget proposes setting up 50,000 Tinkering Labs in schools and enhancing broadband connectivity in rural educational and health institutions.

Tourism and Exports

The top 50 tourist destinations will receive development support, and a digital platform for trade documentation will be established.

Aviation

A modified UDAN scheme will improve regional connectivity to 120 new destinations over the next decade.

Key Announcements for Bihar

Bihar will see the facilitation of greenfield airports and expansions at existing airports, alongside support for the Western Koshi Canal project.

Healthcare Initiatives

The Budget allocates funds for increasing medical college seats and establishing day-care cancer centers in district hospitals.

Budget Moves for MSMEs

Classification limits for MSMEs will expand, with enhanced credit guarantee covers to boost access to credit.

India Post Transformation

India Post will be revamped to support rural economies and businesses through a public logistics organization.

In essence, Budget 2025 emphasises tax relief, agricultural growth, infrastructure development, and a reform push, particularly benefiting the middle class and rural sectors.

Finance Minister Nirmala Sitharaman unveiled the first full Budget of Modi 3.0 today, focusing on tax relief for the middle class, allowing total tax exemption for income up to Rs 12 lakh per annum. In her speech, she emphasized the Budget's goals of supporting the GYAN (Garib, Yuva, Annadata, and Nari shakti) — the poor, farmers, women, and youth. She also made notable announcements for Bihar, where elections are anticipated later this year.

Budget 2025: Major Highlights

Budget Theme

The Budget aims to implement transformative reforms in six key areas: taxation, power, urban development, financial sector, mining, and regulatory reforms. It emphasizes inclusive development to enhance middle-class spending power, viewing the next five years as a unique opportunity for widespread growth.

Income Tax Changes

A New Income Tax Bill will be introduced next week, featuring no income tax for incomes up to Rs 12 lakh and nil tax on Rs 12.75 lakh due to a standard deduction. The proposed simplified tax structure will benefit taxpayers across various income brackets. Notable changes include doubling the tax deduction limit for senior citizens and removing TCS on education remittances.

Following are the revised slabs and rates under new tax regime announced in the FY26 Budget:

Income up to Rs 4 lakh (per annum) ----- Nil

Between Rs 4 and 8 lakh ---------------- 5 per cent (tax)

Between Rs 8 and 12 lakh --------------- 10 per cent

Between Rs 12 and 16 lakh -------------- 15 per cent

Between Rs16 and 20 lakh --------------- 20 per cent

Between Rs 20 and 24 lakh -------------- 25 per cent

Above Rs 24 lakh ------------------------- 30 per cent

* Nil tax slab will apply for annual income up to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers with a standard deduction of Rs 75,000) under new tax regime.

Tax Moves for Businesses

Significant tax measures include making 36 life-saving drugs duty-free, cutting custom duty on lithium batteries, and reducing BCD on various goods. An asset monetization plan aims to generate Rs 10 lakh crore, while FDI in the insurance sector will increase to 100%.

State of the Economy

The FY25 fiscal deficit is projected at 4.8%, with a revised capex of Rs 10.18 lakh crore. Total receipts and expenditures for FY26 are estimated at Rs 34.96 lakh crore and Rs 50.65 lakh crore, respectively.

Big Measures for Agriculture

Initiatives include a new urea plant in Assam, a National Mission on High Yielding Seeds, and a five-year mission to boost cotton productivity. The Modified Interest Subvention Scheme will raise loan limits for farmers, and a PM Dhan Dhyan Krishi Yojana will target low-yield districts.

Reforms Announced

Plans include developing an asset monetization strategy and setting up a High-Level Committee for regulatory reforms. A National Manufacturing Mission will be launched to boost India's production capacity.

Infrastructure and Economy

Each ministry will devise a three-year project pipeline for PPP implementation, and states will receive Rs 1.5 lakh crore in interest-free loans for infrastructure development.

Education Schemes

The Budget proposes setting up 50,000 Tinkering Labs in schools and enhancing broadband connectivity in rural educational and health institutions.

Tourism and Exports

The top 50 tourist destinations will receive development support, and a digital platform for trade documentation will be established.

Aviation

A modified UDAN scheme will improve regional connectivity to 120 new destinations over the next decade.

Key Announcements for Bihar

Bihar will see the facilitation of greenfield airports and expansions at existing airports, alongside support for the Western Koshi Canal project.

Healthcare Initiatives

The Budget allocates funds for increasing medical college seats and establishing day-care cancer centers in district hospitals.

Budget Moves for MSMEs

Classification limits for MSMEs will expand, with enhanced credit guarantee covers to boost access to credit.

India Post Transformation

India Post will be revamped to support rural economies and businesses through a public logistics organization.

In essence, Budget 2025 emphasises tax relief, agricultural growth, infrastructure development, and a reform push, particularly benefiting the middle class and rural sectors.