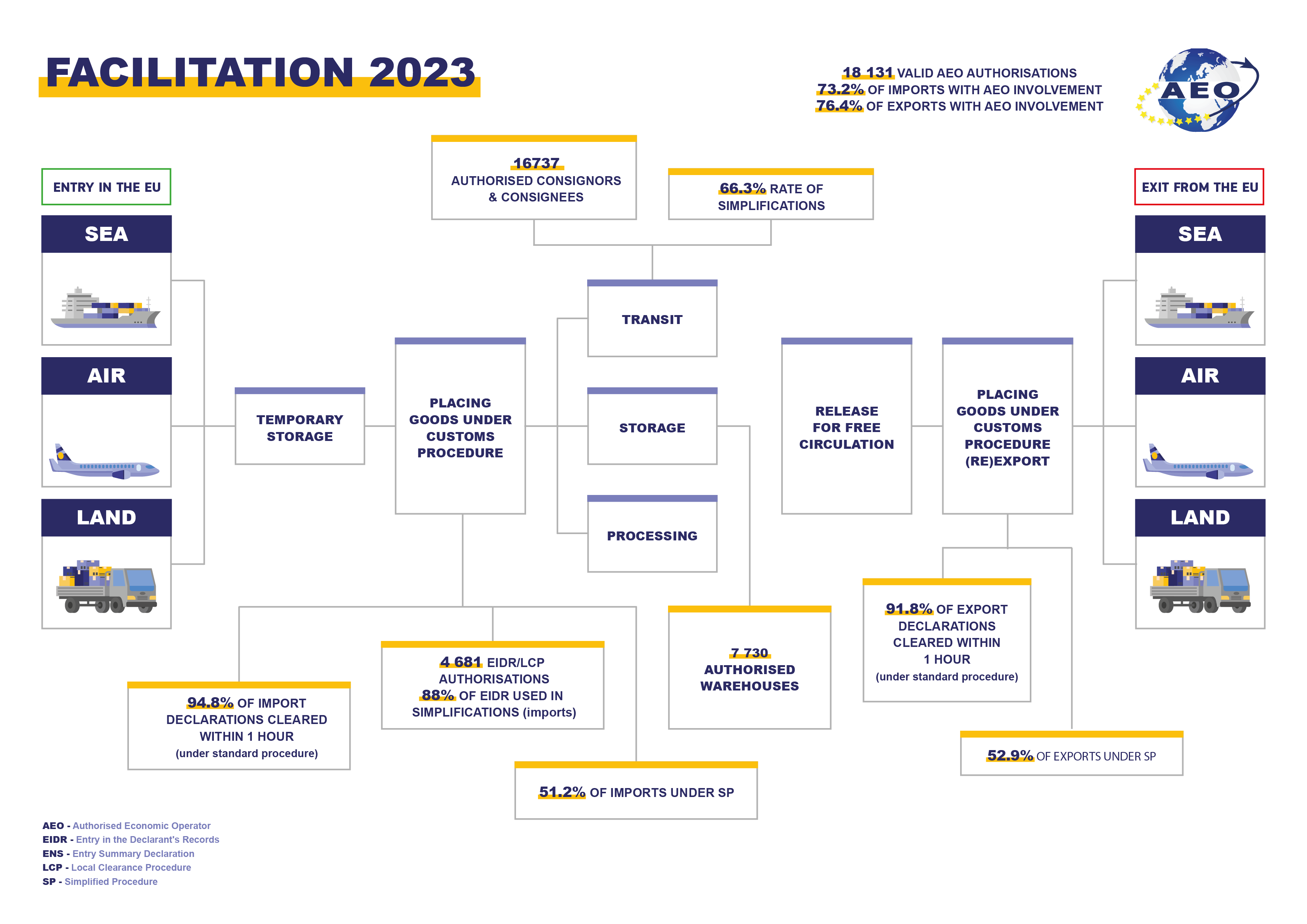

The Union Customs Code aims to maintain a proper balance between customs controls and facilitation of legitimate trade, to enable the EU to prosper and develop competitive businesses.

Source: DG Taxation and Customs Union

Business operators

To be able to carry out commercial activities related to importing and exporting goods (in the role of a consignee, declarant or representative), business operators have to register in the Economic Operators Identification and Registration system (EORI).

At the end of 2023 there were over 8.7 million entities registered in the EORI system (8.3 million in 2022).

Authorised Economic Operators (AEO)

An important instrument for trade facilitation is the Authorised Economic Operator (AEO) regime. AEO status provides for a more favorable treatment in the areas of customs simplification and facilitation. AEOs are playing an increasingly important role in the supply chain in terms of the number of goods declared.

AEO involvement in trade by direction – import (orange), export (green), transit (blue) (2019-2023)

The overall involvement of AEOs in imports and exports remained at high level, and the participation rate in both directions further increased: in import (73.7% vs 71.9%), and in exports (85.2% vs 78.7%). As a result, the participation rate of AEOs in export and import traffic was harmonized.

Source: DG Taxation and Customs Union

Processing time

Clearing customs declarations quickly is key to trade facilitation as goods immobilised at the border, at a customs office or at traders’ premises, represent an avoidable cost for economic operators.

In CUP, processing time has been measured for years for trade under standard procedure, which does not require specific authorisations. This year a pilot was added for tracking the processing time for simplified declarations at import in addition to standard procedure. (H7 declarations are EXCLUDED for processing time measurement)

Percentage of import declarations cleared by processing time periods (EU, 2023, standard procedure) and percentage of import declarations cleared within 1 hour (EU, standard procedure).

Source: DG Taxation and Customs Union

Simplifications

Simplifications such as the simplified procedure or authorised warehouses enable business operators to perform customs procedures faster and more efficiently reducing administrative burden and costs.

In 2023 the share of imported items under simplifications was 51%, a once again drop compared to 2022, when the share was 60%.

Paperless environment

The electronic customs systems are crucial for the operation of the Customs Union. The replacement of paper based customs procedures with EU wide electronic procedures has created a more efficient and modern customs environment.

Nowadays nearly all customs declarations are submitted electronically. With the ongoing implementation of the Union Customs Code electronic systems, EU traders will be able to use customs electronic systems for other elements of their business operations.